The last 50 years has seen a rise in a Financial Agreement due to the greater acceptance of de facto relationships as well as the rise of the second, third (and beyond) marriages.

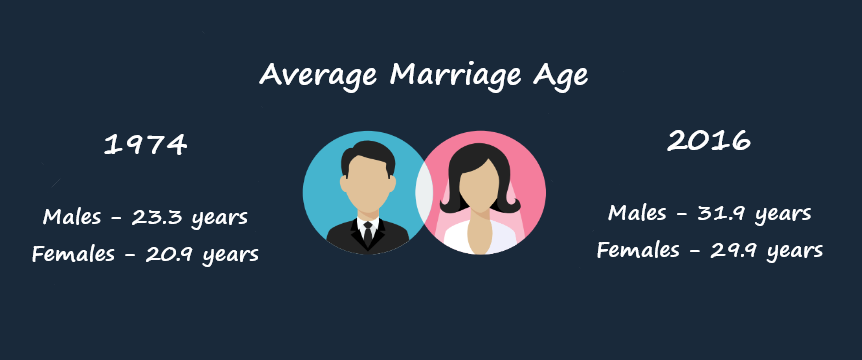

Data from the Australian Bureau of Statistics has also demonstrated the significant increase in marrying ages of both males and females in Australia. See below.

There is no doubt that changes to relationship trends and dynamics have occurred worldwide. Now, when people marry or enter into new relationships, they often have significant assets, business interests, and high incomes.

Prenups were once known to be “not worth the piece of paper they were written on”. However, that perception is also very different nowadays.

A properly prepared prenup will provide the best possible security and peace of mind for people entering into new relationships, whether a de facto relationship or a marriage.

The purpose of this post is to provide some insight into prenups generally and highlight some situations when you should consider having one.

What is a prenup?

A prenuptial agreement (or prenup, as it is more commonly known) is an American concept. In Australia, we don’t refer to them as prenups. They are called Financial Agreements.

People can enter into a Financial Agreement at the following times:

– Before marriage;

– Before a de facto relationship;

– During a marriage;

– During a de facto relationship;

– After divorce; or

– After a breakdown of a de facto relationship.

This post focuses on Financial Agreements before a marriage / de facto relationship.

What can my Financial Agreement cover?

Financial Agreements typically cover the following:

It is largely up to you and your partner when deciding on the actual terms to be included in your Agreement. These Agreements can be extremely flexible and tailored to suit your individual situation.

You will need to consider a range of issues and your family law solicitor will assist you with negotiating appropriate and thorough terms to include.

Should I use a Financial Agreement?

If any of the following applies to you, then you should consider a Financial Agreement:

– Second relationships

People who are entering into second marriages or relationships are our most common Financial Agreement clients.

Why? Usually both parties will have children and wealth from previous relationships, and they may wish to retain part or all of that wealth for the benefit of their children and so on. Many will have also experienced the financial pain of a previous separation and wish to avoid ever going through that process again.

Having a Financial Agreement will spell out exactly what will happen in the event of separation.

– Business owners

When one or both parties have a business, a Financial Agreement is almost always warranted. It protects the business’ assets and also protects the non-owner spouse from potential business liabilities.

– Future inheritances

If you know that you are going to come into some money or inheritance in the future, then a Financial Agreement may be appropriate for you. This can also include gifts of money from family members during their lifetime.

A Financial Agreement can spell out that any inheritance you receive in the future (or for example, any contribution you make to purchase a property using your inheritance) will remains yours.

– Disparity in assets

It is common for one party to have greater assets than the other. A Financial Agreement can spell out whether those assets will be kept separate or how they will be taken into account in the event of a separation.

This situation can be particularly difficult when the couple who plans to enter into a Financial Agreement on this basis are young and/or will have children in the future. An experienced family lawyer will be able to give options and advice to take into account these circumstances and ensure the Agreement will hold up if tested in the future.

– Vastly different incomes

Earning more or less than your spouse generally isn’t an issue while you are in a relationship; however, it can be the basis for dispute in the event of separation. A Financial Agreement can cover the issue of spousal maintenance.

Can I prepare the Financial Agreement myself?

No. You cannot prepare a binding and legally enforceable Financial Agreement yourself.

Why? For a Financial Agreement to be binding and enforceable, it is a legal requirement that people entering into these agreements receive independent legal advice from qualified solicitors before signing them.

Takeaway Point

A prenup may be a difficult discussion; however, it can save you both a lot of hassle, time and money. While we understand that these agreements are not for everyone, for many the peace of mind of knowing that there is an agreement in place that won’t be open for dispute is worth the conversation.

Would you like further information?

If you would like further information on Financial Agreements, please contact us today or book an appointment online.

By Tegan Martens

Director & Principal Family Lawyer

Martens Legal

Disclaimer:

The information contained on this site is for general guidance only. No person should act or refrain from acting on the basis of such information. You should seek appropriate professional advice based upon your particular circumstances.